What is a licensed Mortgage Loan Originator (MLO)?

Sometimes referred to as a loan officer, a Mortgage Loan Originator is defined by the SAFE act as “an individual who for compensation or gain, in expectation of compensation or gain, takes a residential mortgage loan application, or an individual that offers or negotiates terms of a residential mortgage loan.” What does this mean? It means, in a nutshell:- They gather all of the required loan documentation from the borrower, including the application and the credit report,

- They help the borrower determine the right type of loan for their needs, and

- They work with an underwriter to get the loan approved.

About the NMLS Exam

If the definition of MLO didn’t scare you off, and you still plan to pursue a career as an MLO, then there’s a couple of legal hoops that you have to get through in order to obtain your license and be recognized by the state.

You must:

- Take an NMLS 20-hour pre-license education (PE) course

- Pass the National SAFE Act Exam with a score of 75% or more for the National Exam with Uniform State Content (UST).

- If you are seeking licenses in state that has not adopted the Uniform State Test (UST), you will have to pass an additional State Specific Test. (Minnesota, South Carolina, West Virginia & Utah)

- Once licensed, MLOs are also required to complete 8-hrs of continuing education every year in order to renew their license.

It’s worth noting that the pass rate on this test is 65.5% for the first attempt.

(Subsequent attempts is only 46.7%, so it’s safe to assume this is not an easy test.)

In my extensive career in real estate and mortgage training, I’ve come across individuals that have PhDs, Master’s degrees, and even years of experience as a Real Estate Broker, – who have all failed the exam on their first attempt.

If an individual fails the test, they have to wait 30 days before being eligible to retake the exam.

If they fail three times, the waiting period is six months! Not to mention, each time the exam is taken, there is a fee of $110 – so failing can become quite costly….

In fact, most people simply give up.

This is why you want to pass the NMLS SAFE exam the first time, and not fall victim to the scary statistics. It’s easy to say “I have more than one shot at passing”.

But every time you see failure, it’s going to become harder and harder to pursue this license with the hope of a successful future as an MLO.

Let’s not take the risk – let’s do it right the first time!

Without further ado, let’s get into the top five reasons people fail.

The Top 5 Myths about the NMLS Pre Licensing Exam

1. The 20hr Pre Licensing Course is all you need to do to study for the NMLS exam.

You know from the beginning of this post that the 20hr Pre Licensing Course is a requirement for you to obtain your MLO License… And it’s easy to think of this as a blessing in disguise.

“Hallelujah – I already got all of my studying done! I’m ready to go in and rock my exam!”

Unfortunately, this is a huge myth. It’s suggested to take an additional 10-20 hours to study for your exam on top of your 20hr Pre Licensing Course. Those who work the hardest produce the best results. And while some can get away with bare minimum effort, it’s not worth having to retake your licensing exam just to save an extra couple of hours.

2. You can take any old pre-licensing class and expect fantastic results.

It’s not unusual for a student to choose the cheapest class available in their area – or even choose an online course.

Online courses are a GREAT option for self-motivated learners. However, if you’re new to the industry, it may be best to avoid courses that require to “teach yourself” in the beginning. It’s always beneficial to have a live instructor present, who addresses questions and concerns in a live classroom format.

Even in the live classroom, you may not resonate with a particular teaching style. It’s important to not feel discouraged by this – not every teacher is going to produce the same results. Search for [[an experienced teacher in your area]] or [[online]].

3. You can study by taking practice tests online and memorizing the answers.

Many students believe that adequate preparation for the test just means they have to memorize the questions.

Honestly, students that rely on memorization of the questions and answers will have a tough time passing the NMLS exam. You need to truly understand the content in order to pass (not to mention, there are over 4000 exam questions in the vault!)

For example, so you may know RESPA, TILA, or HMDA…but that’s just the “Tip of the Iceberg”.

Just knowing that you must send out early disclosures within 3 days of the application or that TILA is Regulation Z is not enough to earn you a 75% on this exam.

Instead, the test will contain situational questions that will require you to understand both how and why TILA and RESPA interact with each other. Memorization of the material means nothing if you don’t have a deep understanding of the content itself.

4. Once I feel prepared, I can wait as long as I want to take the exam.

The information on the exam changes frequently, so the longer you wait to take the exam, the more you risk the chance that the information being outdated.

In this industry, things move quickly and without warning – the test you take today may not necessarily be the test you take tomorrow.

5. As long as you know about mortgage-related laws and mortgages in general, you’re ready to take the NMLS exam.

Thankfully, we have an exact breakdown of what’s on the test.

Earlier this year, the NMLS released an updated test outline, reflecting recent changes to the content outline (including TRID, Qualified Mortgage, the Abilty-To-Repay rule and others).

According to the current Content Outline, NMLS SAFE exam questions are divided into five subjects:

- Federal mortgage-related laws (23%)

- General mortgage knowledge (23%)

- Mortgage loan origination activities (25%)

- Ethics (16%)

- Uniform State Content (13%)

Keep these in mind as you study – even if you get every question related to mortgage laws and general mortgage knowledge correct, you’re still missing 54% of the exam! Applicable knowledge is key.

There are over 4,000 possible exam questions, and this number is continually growing with all the new rules and regulations being implemented by the Consumer Financial Protection Bureau (CFPB).

You’re going to get 125 questions.

You have no idea what 125 questions you’re going to get.

In fact, if you fail the exam and retake it, it’s possible (and likelt) that you can get entirely different set of 125 questions! This is what makes it so difficult to master this exam.

How can we help?

If you have read this far, I can safely assume that you know that you’re worth the investment it takes to pass the NMLS SAFE test the first time.

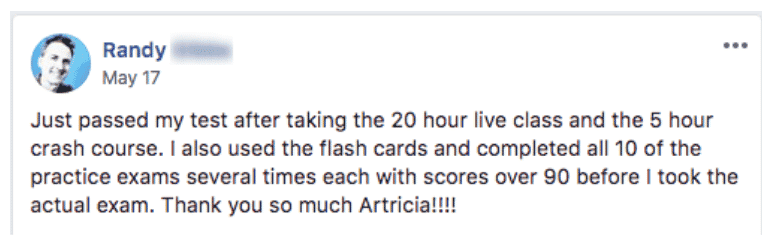

Affinity Real Estate & Mortgage training has helped thousands of individuals pass the NMLS Exam and become licensed loan originators. We currently have a 92% pass rate among student that have taken our courses.

Yes, 92%! Recall that the average first time pass rate is just 65.5%. This type of success is unheard of.

Ready to become a Mortgage Loan Originator? Check out our online prep course to see how Affinity can help you out!

To get MORE free information from me, make sure you don’t miss the FREE download!

0 Comments